A stock market bubble happens when share prices rise far beyond the actual value of the shares. Investors get caught up in speculative buying and push up prices unrealistically high. But bubbles eventually burst, leading to a sudden crash in prices. Understanding how stock market bubbles form, grow, and pop can help investors make smarter decisions and avoid getting burned.

How Do Stock Market Bubbles Form?

If you are interested in bitcoin trading check how why btc has so much support from investors. Here are several factors can contribute to the formation of a bubble:

Excess Liquidity

When there is a lot of money available for investing, it can flow into certain “hot” stocks and inflate their prices. Easy monetary policies and low interest rates often precede bubbles.

New Technologies or Industries

Investors tend to get over-excited about the prospects of new technologies or industries. During the dot-com bubble in the late 1990s, internet company stocks shot up in price as investors raced to grab a piece of the action.

Unchecked Speculation

Speculation is when investors buy stocks in hopes of selling them at a profit later. Excessive speculation drives stock prices up further as more investors try to make a quick buck.

Herd Mentality

Seeing stock prices rise rapidly, more investors jump in for fear of missing out. This herd mentality feeds the bubble further.

Irrational Exuberance

This is a state of unchecked optimism where investors ignore fundamentals and assume “this time it’s different.” Warning signs are disregarded.

How Do Stock Market Bubbles Grow?

Once a bubble starts forming, it can grow rapidly as the dynamics reinforce each other:

- Rising stock prices attract more speculative buying.

- News of spectacular gains spreads, fueling the herd mentality.

- More money pours into the stock market, pushing prices higher.

- Analysts make unrealistic projections about future earnings and growth.

- Investors develop a false sense of confidence that prices will keep rising.

- Warning signs are ignored and rise seems endless.

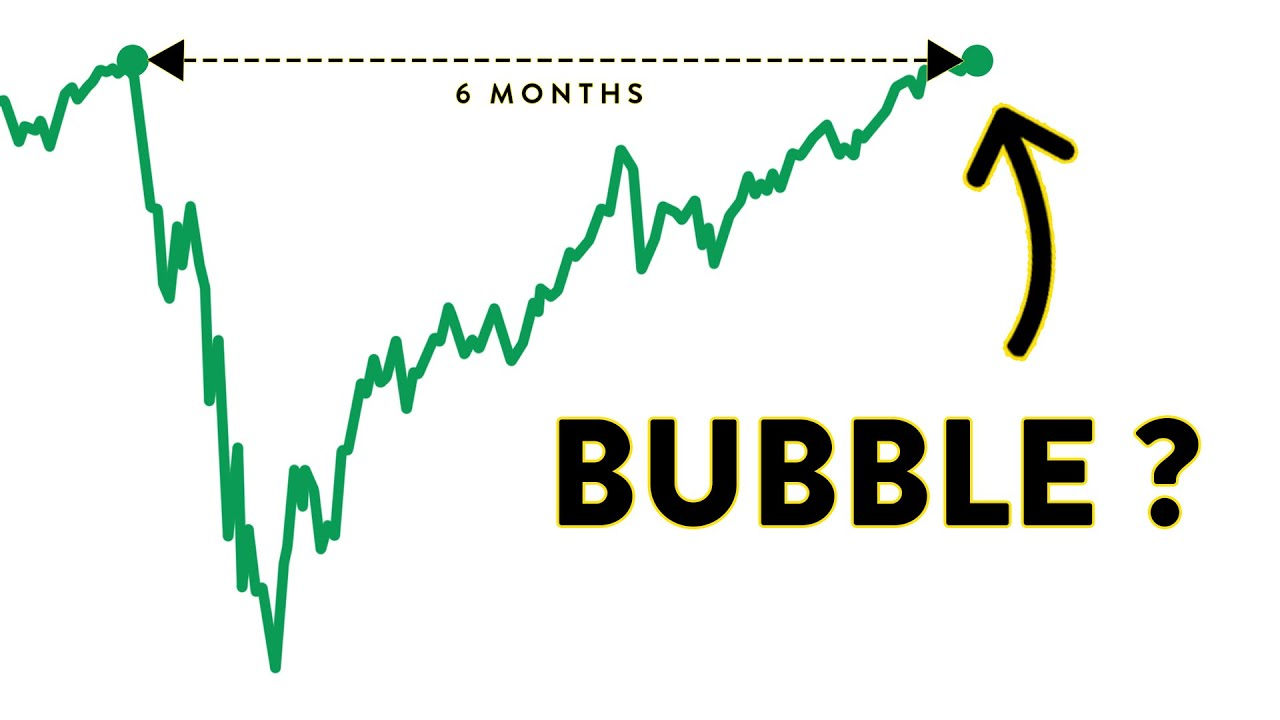

This self-reinforcing cycle means stock market bubbles can inflate to staggering levels over short periods. But the underlying fundamentals don’t change and eventually reality catches up.

What Causes a Stock Market Bubble to Burst?

Stock market bubbles don’t last forever. At some point, the cycle reverses and fear takes over. Some triggers that can pop a bubble include:

- Investors taking profits – As prices peak, big players start selling to realize gains.

- Bad news – Unexpected negative events like poor earnings can undermine confidence.

- Rising interest rates – Makes speculative investments less attractive.

- Overvaluation – Fundamentals catch up and stocks become overpriced.

- Panic selling – Seeing prices drop, investors scramble to unload shares.

- Margin calls – Investors who bought shares on credit are forced to sell when prices fall.

Once panic sets in, the plunge can be dramatic as investors bail out of positions. Psychological factors that fueled the bubble now drive the burst.

What Happens After a Bubble Bursts?

The aftermath of a bursting bubble can be severe:

- Share prices collapse as supply outstrips demand. Massive losses are incurred.

- Companies go bankrupt and jobs are lost as markets correct.

- Economic activity slows for a period as wealth disappears and spending decreases.

- Investor confidence is shaken, keeping people out of the stock market.

- Stricter regulations may be imposed to prevent such excesses again.

- Recession can follow if the bubble was fueled by credit expansion.

Markets eventually stabilize at lower, rational price levels. But bubble bursts leave behind a trail of damage that can take years to recover from.

Can Investors Profit From a Bubble?

Trying to time and profit from a bubble carries big risks:

- It’s hard to identify the peak and exit before the burst. Greed often causes investors to hold too long.

- Shorting to profit from the bubble popping is very risky and requires exquisite timing.

- Getting the timing wrong can lead to huge losses as mania continues.

Bubble stocks seem like a chance to make easy money. But most investors end up buying high and selling low, suffering big losses. It’s prudent to avoid the herd mentality and stick to fundamentals.

How Can Investors Avoid Getting Burned?

Some tips to avoid losing money in bubbles:

- Don’t chase hot stocks with unsupported valuations. Stay disciplined.

- Balance your portfolio across asset classes and geographies. Don’t overload on bubble stocks.

- Focus on long-term fundamentals rather than short-term price movements.

- Don’t use excessive leverage or buy on margin. This increases downside risk.

- Set stop losses to protect profits and cut losses if bubble bursts.

- Diversify and hedge rather than trying to time the market.

- Keep some funds in cash to deploy if bargains appear after crash.

By tuning out market euphoria and sticking to sensible principles, investors have the best chance of avoidingbubble losses.

Conclusion

Stock market bubbles form when speculation and irrational exuberance take over and inflate share prices far above real value. The bubble eventually reaches an unsustainable peak and then bursts, leading to a market crash. While bubbles may seem like opportunities to get rich quick, they often end in losses for most investors. By focusing on fundamentals rather than hype, diversifying smartly, and avoiding excess leverage, investors have the best chance of navigating bubbles safely. Though painful when they burst, bubbles do teach important lessons about investor psychology and valuations.

FAQs

What causes irrational exuberance in stock markets?

Irrational exuberance occurs when investors get caught up in enthusiasm and speculation, ignoring fundamentals and driving stock prices up to unsustainable levels. Easy monetary policy, new technologies, strong economic growth, and psychological factors like herd mentality can all contribute to irrational exuberance.

How long do stock market bubbles typically last before bursting?

There is no definitive time period, but stock market bubbles are usually short-lived. Some historical bubbles lasted 1-3 years from start to peak before collapsing. The dotcom bubble is an example, peaking in 2000 after forming through the second half of the 1990s. Rapid growth makes bubbles unsustainable.

What is the impact of cheap credit and low interest rates on stock market bubbles?

When credit and borrowing are cheap and easy, it can fuel speculative investing. Low interest rates mean money flows more freely into markets, feeding bubbles in assets like stocks. This flood of liquidity helps inflate prices beyond reasonable values.

Which sectors are most prone to stock market bubbles forming?

New sectors and industries where valuations are less clear are common bubble candidates. Technology and internet stocks in the 1990s, housing in the 2000s, and cryptocurrencies more recently have all experienced bubble-like surges and crashes.

How do investors know when a stock market bubble is about to burst?

No one can predict the exact peak, but warning signs include overvaluation, excessive speculation, market euphoria, and disconnect from fundamentals. Technical indicators like high P/E ratios can also signal trouble. Sudden drops may precede the full burst.

Should investors try to profit by short selling bubble stocks?

Short selling bubble stocks is extremely risky and difficult to time. Most investors lose trying to call the peak to profit from a bubble bursting. It’s generally safer to avoid speculative bubble stocks altogether rather than short them.

What usually happens to stock prices right after a bubble bursts?

In the panic selling that follows a bubble bursting, stock prices tend to collapse rapidly as supply overwhelms demand. Prices typically overshoot fair value on the way down just as they did on the way up. This presents eventual buying opportunities.

How long do stock markets usually take to recover after a major bubble bursting?

Recovery times vary depending on the severity, but market crashes triggered by bursting bubbles can take years to finally bottom out. Economies may enter recessions until excesses are worked off. While stocks rebound faster, full recovery can take over a decade.

Is it smart to try to ride a stock market bubble and then get out before it pops?

Trying to time a bubble peak to profit is extremely difficult even for professionals. It requires impeccable timing and discipline to exit positions. Most investors fail to sell in time and end up suffering large losses in the burst. It’s generally safer not to directly participate.

Disclosure: The articles, guides and reviews on BlowSEO covering topics like SEO, digital marketing, technology, business, finance, streaming sites, travel and more are created by experienced professionals, marketers, developers and finance experts. Our goal is to provide helpful, in-depth, and well-researched content to our readers. You can learn more about our writers and the process we follow to create quality content by visiting our About Us and Content Creation Methodology pages.